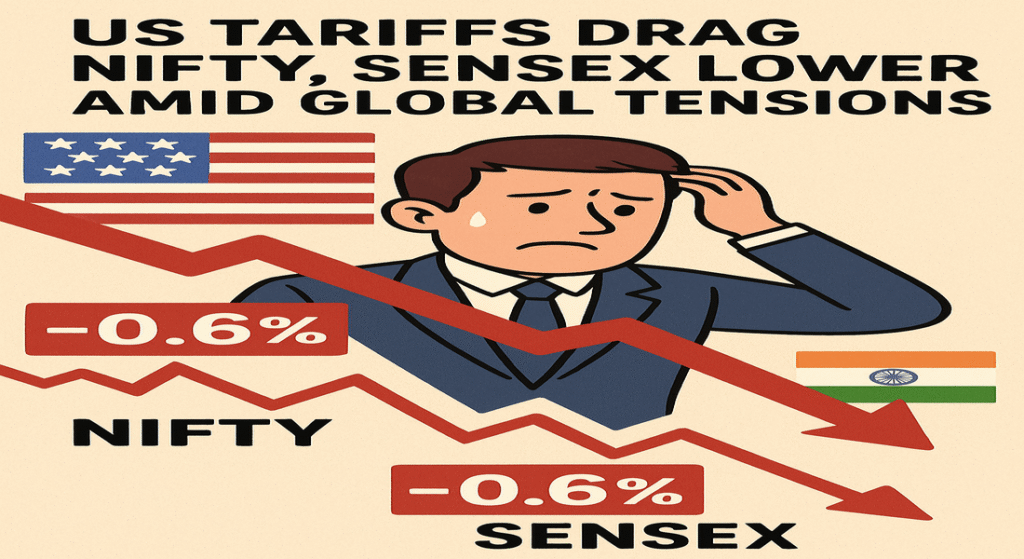

The Indian stock market faced a sharp setback today as news of the United States imposing 50% punitive tariffs on Indian exports rattled investor confidence. Both the Nifty 50 and Sensex slipped by around 0.6%, reflecting broad-based weakness across sectors.

What Triggered the Fall?

The announcement from Washington of higher duties on key Indian exports such as textiles, leather, and jewelry has sparked fears of a slowdown in trade flows. Analysts suggest this move could also strain diplomatic ties, creating a ripple effect across industries.

Sector Impact

- IT & Tech: Global uncertainty weighed on large-cap IT stocks like TCS, Infosys, and HCL Tech, dragging the Nifty IT index lower.

- Banking & Financials: Heavyweights such as HDFC Bank and Shriram Finance were among the top losers, signaling weak investor sentiment in financials.

- FMCG & Consumer: Companies like Titan and Asian Paints, however, managed to post modest gains, offering some resilience in an otherwise red market.

Broader Market Picture

Small-cap and mid-cap indices also declined nearly 0.9%, highlighting the widespread selling pressure. Experts believe the correction is more sentiment-driven rather than fundamental, as India’s domestic growth story remains strong.

Key Gainers and Losers

- Top Gainers: Titan, L&T, Coal India, Hero MotoCorp, Asian Paints

- Top Losers: Shriram Finance, TCS, HCL Technologies, Power Grid, Infosys

What Should Investors Do?

Market experts recommend a cautious, long-term approach rather than reacting to short-term volatility. While export-linked sectors may face near-term challenges, domestic consumption and infrastructure-related themes are likely to remain strong.

Conclusion

The tariff announcement has clearly shaken markets in the short run, but India’s structural growth drivers—rising domestic demand, government spending on infrastructure, and a resilient corporate sector—continue to provide a strong long-term foundation. Investors should focus on diversification and avoid panic selling during such global shocks.

https://rxwealthcreation.com/tariffs-trading-turmoil-whats-driving-markets-now/