Share market today: The Indian stock market began the week on a positive note (September 8, 2025), as fresh optimism from the government’s GST 2.0 reforms lifted investor sentiment. Both Nifty 50 and Sensex ended the day higher, powered by strong buying in auto and metal stocks.

🚀 Market Snapshot

- Nifty 50: Closed above 24,750, up 32 points

- Sensex: Gained 70+ points

- Sectoral Moves: 13 of 16 sectoral indices advanced

- Mid & Small-Caps: Added 0.3%–0.6%

📌 What Drove the Market?

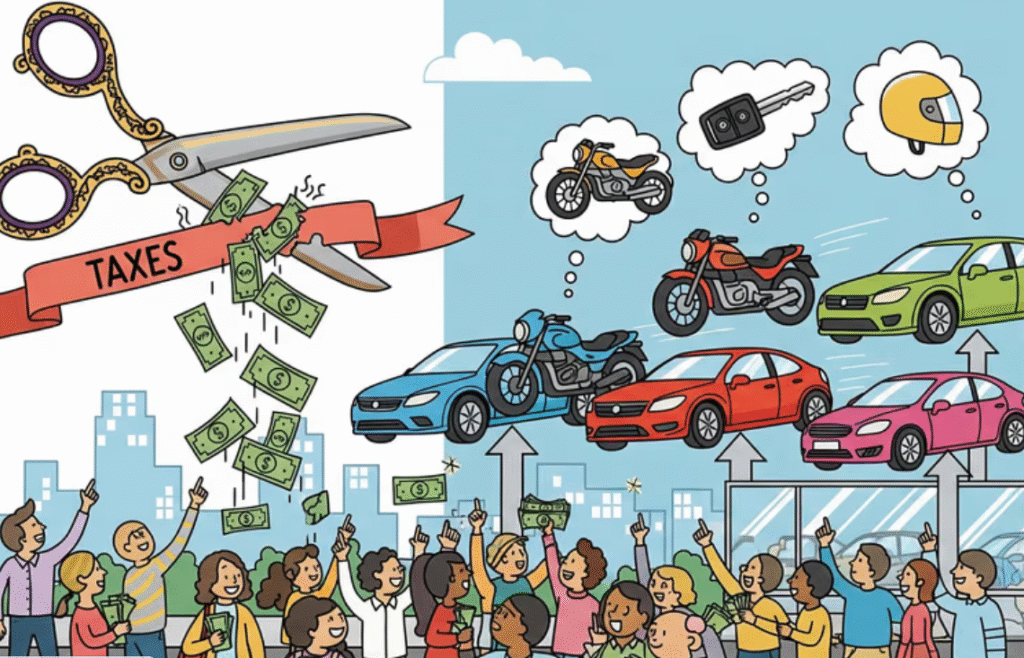

1. GST Boost to Autos

Automakers stole the show after the government’s GST rate cuts. Companies passed on the benefits to customers, sparking a rally in the sector.

- Tata Motors surged ~3.2%, announcing immediate vehicle price reductions.

- Other auto majors like Maruti and M&M also ended in the green.

👉 Cheaper cars and two-wheelers are expected to trigger stronger festive season demand.

2. Metals Shine Bright

The metals pack saw solid momentum, driven by upbeat global cues and brokerage upgrades.

- JSW Steel, Tata Steel, and SAIL jumped ~3% each.

- Global optimism from China’s steel industry reforms added fuel to the rally.

Analysts believe this could be the start of a strong upcycle for the sector.

3. Broker Calls That Moved Stocks

Brokerages were active with fresh recommendations:

- Reliance Industries: Jefferies upgraded to Buy, citing strong O2C earnings growth.

- Swiggy: Motilal Oswal set a bullish target of ₹560 (28% upside).

- Phoenix Mills: Seen as a long-term growth story with a 35% upside potential.

4. IPO Buzz Keeps Markets Excited

The Urban Company IPO, opening on September 10, has already built strong anticipation with a grey market premium of ₹28.

Meanwhile, the Austere Systems IPO saw oversubscription of 8×, reflecting robust appetite for new-age companies.

5. Not All Stocks Shined

Despite the broad rally, some counters lagged:

- Asian Paints slipped ~1.9%, underperforming the market.

The stock continues to trade nearly 25% below its 52-week high.

📊 Bottom Line

Today’s market action reflected the power of domestic policy reforms. GST cuts have immediately boosted optimism in consumption-driven sectors like autos and metals, while IPO activity is keeping liquidity buzzing in the primary market.

Investors will now keep an eye on:

- Upcoming Urban Company IPO listing

- Festive season sales data for autos and FMCG

- Global cues around U.S. rate cut decisions

✅ Takeaway for Investors:

The auto and metals rally shows how policy changes directly impact sector growth. For long-term investors, this could be a good time to track leaders in these spaces while keeping a diversified approach.

https://rxwealthcreation.com/stock-market-today-auto-it-lead-on-gdp-boost/

Pingback: Today’s Stock Market Report: Bank & Metal Lead Rally

Pingback: PSU Banks, Metals & IPOs Shine on Dalal Street