Stock Market Today: Auto Gains, IT Drags

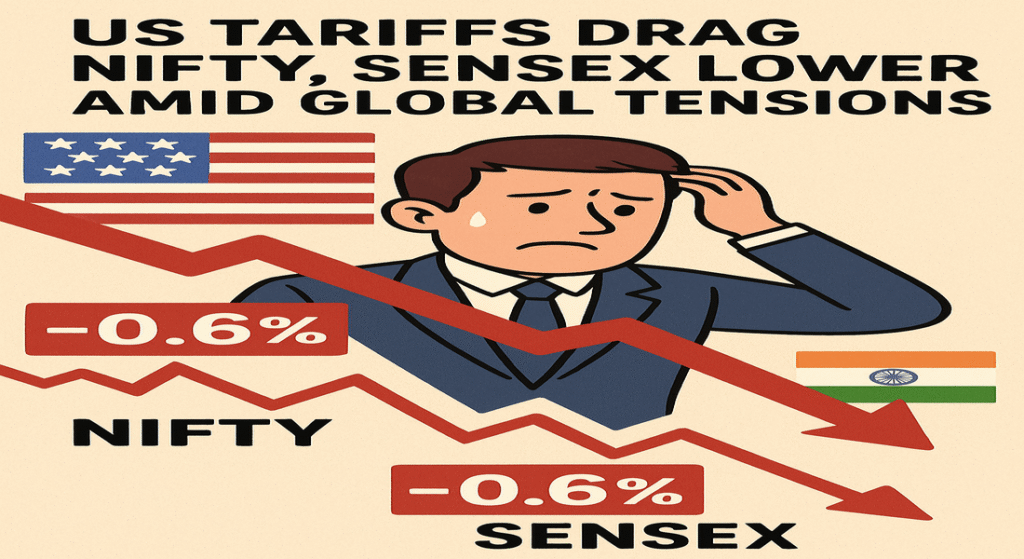

The stock market today: The Indian stock market had quite a tug-of-war on September 5, 2025. Optimism around the government’s new GST 2.0 reforms lifted spirits early in the day, but investors turned cautious as global uncertainties and profit-booking kicked in. In the end, both Sensex and Nifty 50 closed almost flat—showing just how divided […]

Stock Market Today: Auto Gains, IT Drags Read More »