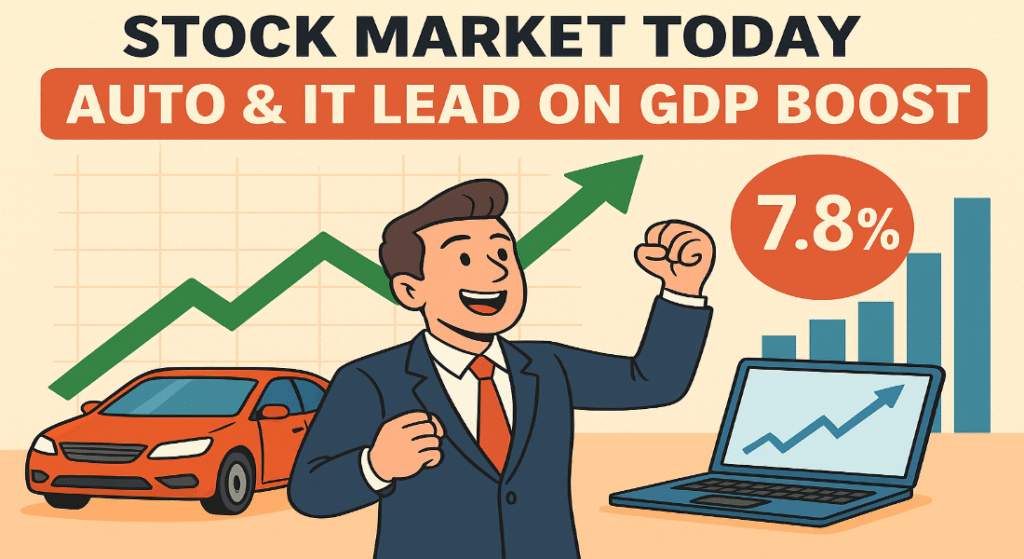

📈 Market Overview

Indian equities started September on a strong note, snapping a three-day losing streak. The rally came after India’s Q1 GDP growth surprised at 7.8%, reaffirming its position as the fastest-growing major economy. A U.S. court ruling questioning Trump-era tariffs also boosted global sentiment, adding to domestic optimism.

The Nifty 50 closed above 24,600, up nearly 0.8%, while the Sensex gained over 550 points.

🔑 Key Highlights from Today’s Market

- Auto sector (+2.8%) led the rally, supported by festive demand outlook and strong sales momentum.

- IT sector (+1.6%) gained on hopes of U.S. rate cuts and stable global tech spending.

- Torrent Power surged after bagging a massive ₹22,000 crore order.

- PG Electroplast rose ~2.3% after announcing a ₹1,000 crore expansion plan.

- Broader market sentiment improved, with mid- and small-caps also seeing renewed buying.

🚗 Auto Sector in Focus

The auto index outperformed all sectors today. Stocks like Maruti Suzuki, Tata Motors, and M&M posted strong gains, driven by positive demand expectations ahead of the festive season and easing input costs.

Industry analysts believe auto stocks could remain attractive in the short term, especially with new launches and government incentives for EV adoption.

💻 IT Sector Gains Ground

IT stocks were back in demand as Infosys, TCS, and Tech Mahindra led the rally. The sector benefited from global cues, including expectations of a U.S. Federal Reserve rate cut, which could improve corporate spending on technology.

Tech Mahindra, in particular, outperformed peers, rising nearly 1.7%.

⚡ Power & Energy Highlights

- Torrent Power (+2.1%) jumped after securing a record ₹22,000 crore order.

- Solar Industries India gained ~2% on strong earnings momentum.

- Utilities and energy stocks continue to attract investors looking for long-term growth stories.

🌍 Why Markets Are Rallying

- India’s GDP beat estimates, reinforcing strong macro fundamentals.

- Global relief from the U.S. tariff court ruling eased investor concerns.

- Hopes of Fed easing supported flows into emerging markets like India.

🔮 What Investors Should Watch Next

Key triggers that could drive market direction in the coming weeks:

- GST Council meeting for tax reforms and policy clarity.

- Auto sales data for September, critical for gauging festive demand.

- U.S. tariff deadline in October, which could swing global trade sentiment.

- FII/DII flows, which remain volatile amid global uncertainty.

📊 Bottom Line

Today’s rebound highlights India’s resilience amid global volatility. For investors, Auto and IT stocks look promising in the near term, while power and infra sectors could deliver strong long-term returns.

With India’s growth momentum intact, dips in quality stocks may continue to offer attractive entry opportunities.

https://rxwealthcreation.com/gst-rate-cuts-spark-market-rally-investor-watch-points/

Pingback: Share Market Today: Auto & Metal Stocks Rally on GST