Market Mood: Optimism Returns

Dalal Street wore a smile today as investors cheered fresh momentum from both domestic reforms and global diplomacy. The Sensex gained nearly 370 points, while the Nifty closed just shy of 25,000, signaling renewed confidence in Indian equities.

At the heart of the rally lies a double boost:

- GST reform buzz — Investors are betting on policy changes that could ease compliance, reduce costs, and unlock consumption growth.

- Global peace talks — Renewed dialogue on the Russia-Ukraine front raised hopes of stability in energy markets and global trade.

Together, these triggers created a feel-good environment that lifted not just heavyweights, but also midcaps and sectoral plays.

🔑 Top Market Drivers

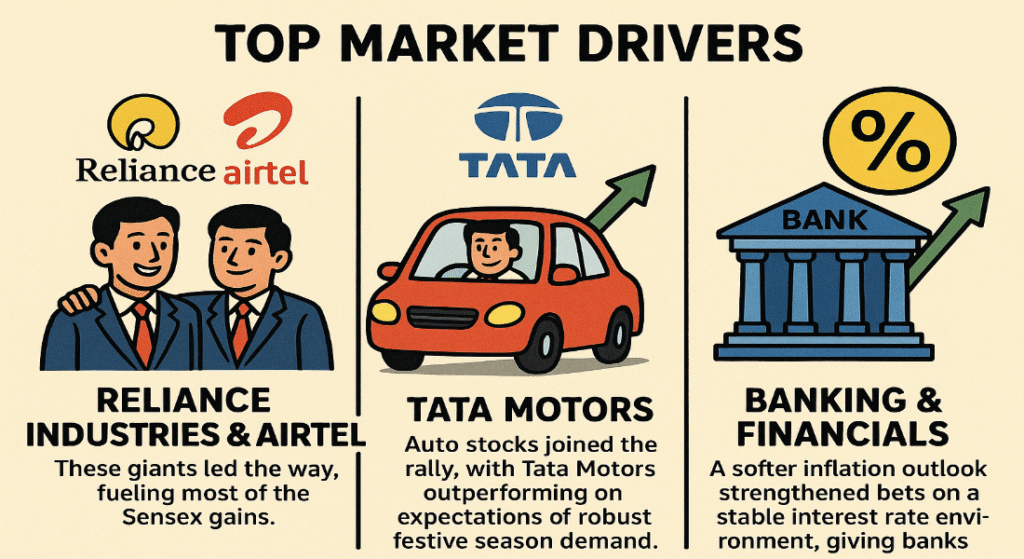

- Reliance Industries & Airtel: These giants led the way, fueling most of the Sensex gains. Reliance’s energy and telecom bets kept buyers interested, while Airtel’s strong subscriber growth numbers attracted inflows.

- Tata Motors: Auto stocks joined the rally, with Tata Motors outperforming on expectations of robust festive season demand.

- Banking & Financials: A softer inflation outlook strengthened bets on a stable interest rate environment, giving banks and NBFCs a lift.

🌍 Global Context Matters

Beyond India, global investors were watching developments closely. Signs of progress in peace talks injected optimism into oil and commodity markets, which in turn eased concerns about imported inflation. Combined with India’s reform narrative, the global cues painted a supportive backdrop for equities.

👀 What Should Investors Watch Next?

- GST Implementation Details: Market enthusiasm is high, but execution will matter. Any clarity from the government could fuel the next leg of the rally.

- Monsoon & Consumption Trends: With festive season demand ahead, sectors like FMCG and autos may benefit.

- Global Geopolitics: While peace talk optimism helped today, investors need to stay cautious about sudden twists.

✅ Bottom Line

Today’s rally is a reminder of how domestic reforms and global cues work hand-in-hand to shape investor sentiment. If GST reforms translate into actionable changes and global peace efforts sustain, India’s markets may find stronger legs for the medium term.

https://rxwealthcreation.com/dalal-street-ahead-gst-reform-geopolitics-key-triggers/

Pingback: India’s Consumption Boom: A Long-Term Investment Story

Pingback: Indian Markets: Jio IPO Buzz & Sector Trends -

Pingback: Share Market update: Sensex Rises, IPOs Steal Show -