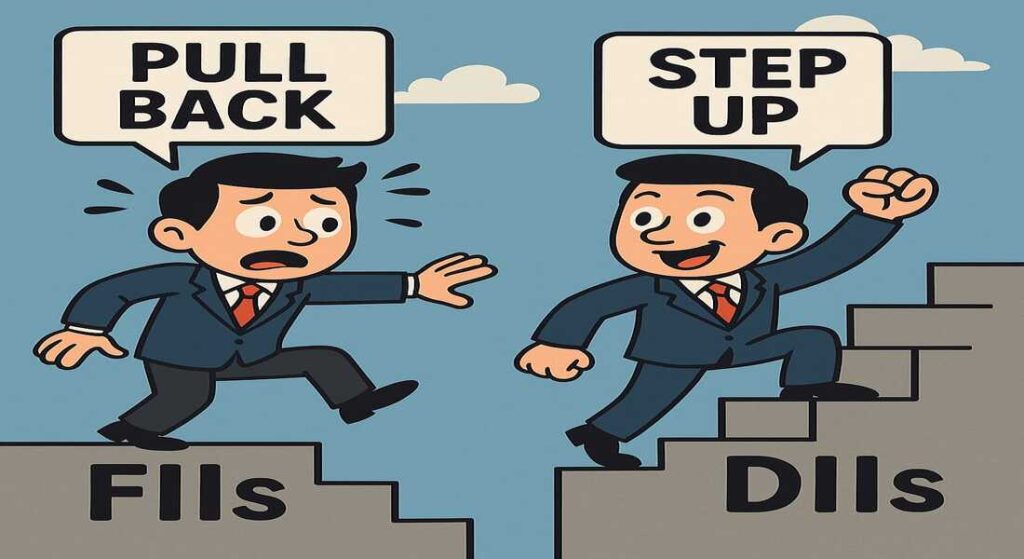

As the Indian equity market rides a wave of volatility, two forces are quietly shaping its direction—Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). While FIIs are increasingly pulling out, the DIIs are stepping in with confidence, creating an interesting tug of war that could define the market’s near-term trajectory.

FIIs Turn Cautious – But Why?

FIIs have gone into risk-off mode, and the data is loud and clear. In the derivatives segment, the FII long-short ratio has dropped to just 15%, a level not seen since February this year. That simply means: they’re betting more on the downside than the upside.

This comes amid growing concerns over:

- Global trade uncertainties, especially rising tariff tensions.

- Mediocre Q1 earnings, which have failed to excite.

- Stretched valuations, making India a bit too hot to handle for some foreign investors.

In fact, FIIs have pulled out over ₹13,500 crore in just one week, dragging indices like the Nifty and Sensex down for a fourth straight week.

DIIs Fill the Gap with Conviction

On the flip side, Domestic Institutional Investors—mutual funds, insurance companies, pension funds—have been active buyers. They’ve poured in nearly ₹18,000 crore in the same week. DIIs are betting on India’s long-term fundamentals, and perhaps even using this correction to accumulate quality stocks at slightly lower prices.

This divergence is not new, but it’s becoming more visible now. When FIIs sell, DIIs tend to buy—and this yin-yang relationship has kept the market from completely falling apart.

What Does It Mean for Retail Investors?

This tug-of-war might feel confusing to individual investors. Who’s right—FIIs or DIIs?

The truth is, FIIs are often influenced by global factors—US bond yields, dollar strength, geopolitical risk—while DIIs focus more on domestic fundamentals. Both can be right in their own context.

But here’s what retail investors can take away:

- Don’t panic just because FIIs are selling—they often come back just as quickly.

- Use corrections as opportunities, but only for fundamentally strong companies.

- Keep a long-term view. The short-term noise is exactly that—noise.

Final Thoughts

The market is in flux. FIIs are sounding the alarm, DIIs are holding the line. Somewhere in between, there’s a message for investors: stay balanced, stay informed.

While the big boys fight it out, smart investors focus on what they can control—discipline, research, and patience.

https://rxwealthcreation.com/retail-vs-fii-c-an-domestic-investors-save-the-market-from-global-exit/

https://rxwealthcreation.com/market-mood-turns-sour-will-corporate-results-change-the-game/