The markets started this Monday with hesitation — and honestly, who could blame them?

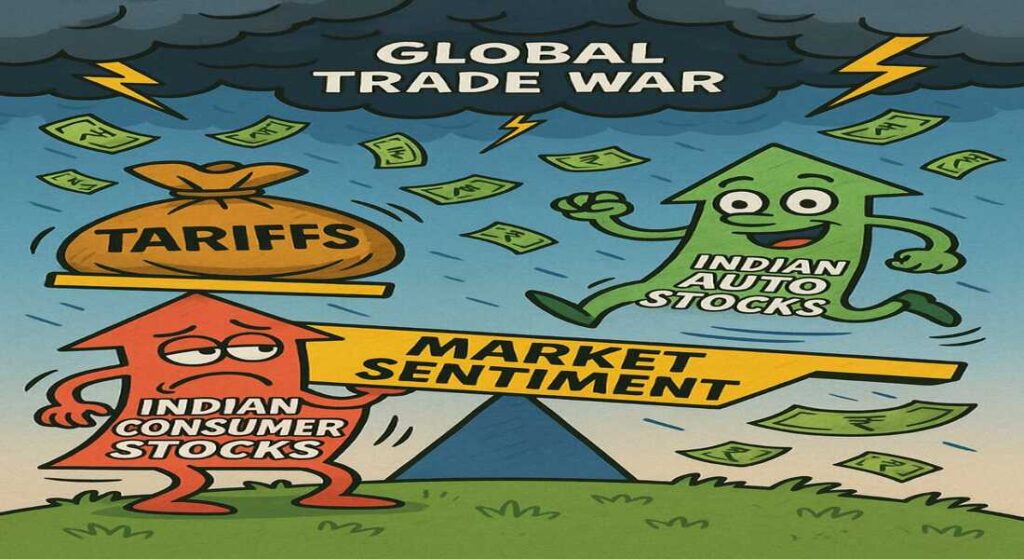

With fresh tariff talks heating up globally, especially between the U.S. and China, investors here in India are beginning to feel the ripple effects. While the broader indices didn’t move much, the undercurrents were clear — nervousness is creeping in.

Two sectors that clearly reflected this mood today were Auto and FMCG — but interestingly, both moved in different directions.

Auto: Cautious Optimism on the Road

Auto stocks were a bit of a mixed bag today. On one hand, two-wheeler giants like Hero MotoCorp and TVS Motors saw modest gains — helped by hopes of better rural demand and steady monsoon progress.

But on the other hand, four-wheeler majors like Maruti Suzuki and Tata Motors stayed under pressure. With growing concerns about international trade barriers and rising input costs, global exposure is starting to feel like a risk rather than a strength.

Investors are clearly staying selective here — backing companies with a strong domestic footprint and minimal dependence on exports.

🛒 FMCG: Holding On, But Feeling the Heat

The FMCG sector, usually a safe haven during volatile times, wasn’t immune today. Stocks like HUL and Dabur remained flat to weak, as fears around raw material inflation and weak global consumer demand weighed in.

That said, ITC continued to do its own thing — with investors still betting on its hotels and paper divisions alongside the core cigarette business. Some light in a cloudy sky.

Overall, cost pressure seems to be the biggest concern here — especially if global trade tensions keep commodity prices on the boil.

Market Mood: Play Safe, Stay Aware

With FIIs selling for the fourth straight day and India VIX ticking higher, it’s clear that global headlines are starting to dominate local action.

While India’s domestic story remains strong, nobody wants to ignore the external noise — especially when it starts hitting key sectors like auto and FMCG.

What Should You Do as an Investor?

If you’re feeling confused by the mixed signals — you’re not alone. But here’s what might help:

- Focus on fundamentally strong companies.

- Look for businesses that are less vulnerable to global trade swings.

- Stay patient — short-term noise doesn’t change long-term value.

Final Thought:

Today’s market was a reminder that we live in a deeply connected world. Even if India’s growth story is intact, global uncertainty can still throw us off balance from time to time.